Today we're going to go through the IRS form W4 for 2024 so I'm going to start with going through the paper version and then we're going to go through the online version which is way more accurate so if you have a paper version or if you have an online portal through work it doesn't matter we're going to be able to get you the answers that you need so you have the correct withholdings then I'm going to show you a paycheck estimator to help you check exactly how much you're withholding from your taxes how big your paycheck will be and to make sure that your W-4 is filled out correctly so let's go ahead and get started with the W4 form the paper version here's the IRS form W4 for 2024 the paper version so at the very top we're going to go ahead and fill out all of your basic information so we're going to start with your name your last name your social security number your address your city state and zip and then in section c you're going to choose whichever filing status applies to you then if we scroll down a little bit we can see here it says complete steps two through for only if they apply to you otherwise skip to step 5. I would actually strongly urge you to skip steps two and three and use the online estimator because going through the paper version and using their tax tables is going to be way more confusing than using the online estimator and the online estimator will be way more accurate in step two it's exactly the same as it was in 2024 however as you can see right here a says reserved for future use and that used...

Award-winning PDF software

How to prepare Federal Withholding Form W 4

About Federal Withholding Form W 4

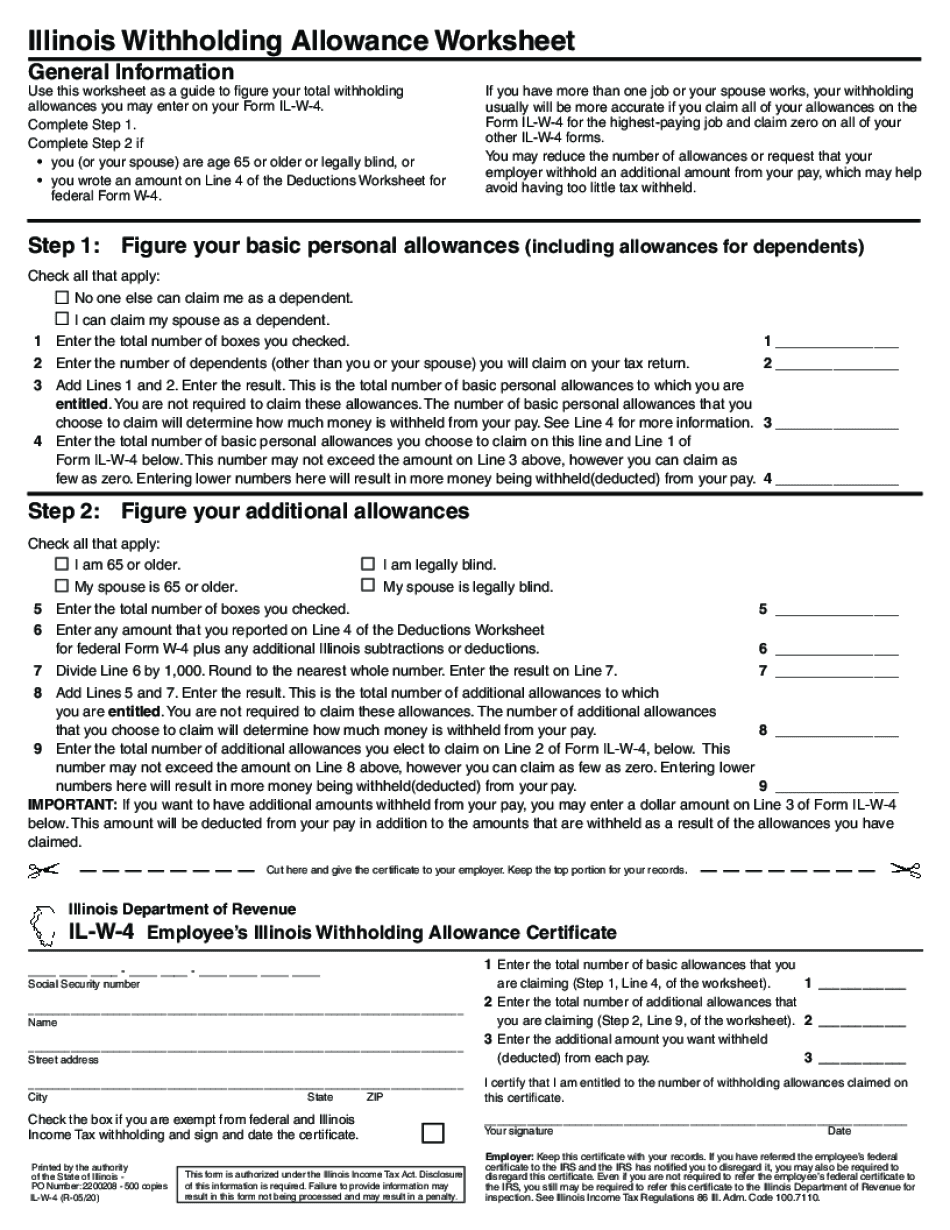

Federal Withholding Form W-4 is a form used by employees to provide their employer with information on how much federal income tax should be withheld from their paychecks. The purpose of this form is to ensure that the correct amount of tax is withheld throughout the year, based on the employee's filing status, number of dependents, and other factors. Employees across the United States need to fill out Form W-4, as it is required by the Internal Revenue Service (IRS). New employees are typically required to complete this form when they start a job, while existing employees may need to update it when their personal or financial circumstances change, such as getting married, having children, or experiencing a significant salary change. The information provided on Form W-4 allows employers to calculate the amount of federal income tax that should be withheld from each paycheck, based on the employee's allowances and exemptions. The form considers factors such as filing status, the number of dependents, and other deductions, all of which help determine the appropriate withholding amount. By accurately completing this form, employees can ensure that they neither overpay nor underpay their federal taxes and avoid any potential penalties or surprises when filing their annual tax returns.

Get Federal Withholding Form W 4 and simplify your everyday file managing

- Get Federal Withholding Form W 4 and begin modifying it by simply clicking Get Form.

- Start filling out your form and include the information it needs.

- Benefit from our extensive modifying toolset that lets you post notes and leave feedback, if needed.

- Review your form and check if the details you filled in is correct.

- Quickly correct any error you made when modifying your form or get back to the earlier version of your document.

- eSign your form easily by drawing, typing, or capturing a photo of your signature.

- Preserve alterations by clicking Done and after that download or send your form.

- Submit your form by email, link-to-fill, fax, or print it.

- Choose Notarize to do this task on the form on the internet using our eNotary, if necessary.

- Safely store your approved file on your PC.

Editing Federal Withholding Form W 4 is an easy and intuitive procedure that calls for no previous coaching. Find everything that you need in a single editor without the need of constantly changing between different solutions. Get more forms, fill out and save them in the format of your choice, and streamline your document managing within a click. Prior to submitting or sending your form, double-check details you filled in and easily correct errors if necessary. If you have any questions, get in touch with our Support Team to help you out.

Video instructions and help with filling out and completing Federal Withholding Form W 4